The biggest news in the world of Bitcoin just broke: Craig Wright claims he is Satoshi Nakamoto, the creator of Bitcoin. Back in December, a number of publications outed Wright as the mysterious founder of Bitcoin, but their revelations were met with great skepticism in the Bitcoin community. Too many holes were in the story, and eventually most concluded that Wright was yet another failed Satoshi candidate. At the time, Wright remained silent, which only added to the skepticism. Now Wright has come public to identify himself as Satoshi.

So, is Craig Wright Satoshi? I have no idea. The fact that Gavin Andresen believes so is significant; after all, he is the person most associated with Satoshi, having interacted with him frequently (online), and having been given the keys to the code after Satoshi retired from managing the project. However, the current Bitcoin core team is suspicious, even revoking Gavin’s commit access keys out of fear that Gavin was hacked:

FYI, @gavinandresen‘s commit access just got removed – Core team members are concerned that he may have been hacked. https://t.co/7re7z16TeR

— Peter Todd (@petertoddbtc) May 2, 2016

Of course, there is no love lost between Gavin and the current core team, so one can’t come to too many conclusions either way from these actions.

With all this drama, sometimes it feels like we are watching “As the Crypto Turns.” Although it can be fascinating to follow, the most important question is…

Does it matter?

When the first stories about Wright appeared back in December, I wrote an article for Bitcoin.com titled ‘Who is Satoshi?’ is the Most Irrelevant Question in Bitcoin. At the time many were fearful that Satoshi going public would have a negative impact on Bitcoin’s price and might be highly disruptive to the internal debates regarding the blocksize limit and the direction of the cryptocurrency. I argued that knowing who is the creator of Bitcoin would have little long-term impact on such issues. I still believe that. But for more fundamental reasons than just the impact on the price or blocksize limit.

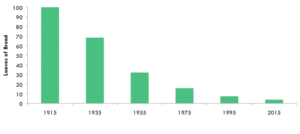

The core issue with modern monetary systems is that they require trust in a third-party. For example, if I write a check to you, you are trusting that the issuing bank has the ability to send money to your bank (which you also have to trust to hold your money). The trust required for modern money goes even deeper, however. All modern money – U.S. Dollar, the British Pound, the European Euro, etc. – is government-issued. When you give the cashier a $20 bill, both you and the store are trusting the U.S. Government that originally issued it: that they will back its value, and will do nothing to harm that value. However, as we have seen over the years, this trust is misplaced. The value of the U.S. Dollar, for example, has decreased by almost 97% since the creation of the Federal Reserve in 1913. Most of us don’t think about this devaluation consciously, but we all know it is true. After all, who hasn’t heard someone older say, “When I was a kid, a gallon of milk only cost…” followed by some ridiculously low number. Do you really think the cost of producing milk has increased over the years? If anything, it has decreased. What has changed is not the value of milk, but the value of the dollar. The trusted third party – the U.S. Government – has broken that trust by devaluing the dollar over the years through inflation (also known by the Orwellian euphemism “qualitative easing”).

Further, only the U.S. Government can issue dollars. Even if we don’t want to trust them with our money, we are forced to by its closed nature. In fact, many of those who have tried to create alternative currencies in the past have been harassed and arrested by the government for moving in on their monopoly.

Although the U.S. Dollar says “In God We Trust,” it would be more accurate to label it, “In Man We Must Trust.” But as the Psalmist long ago said, “Put not your trust in princes, in a son of man, in whom there is no help” (Psalm 146:3). This is good advice when dealing with currency, politics, and life in general.

The Trustless and Open Nature of Cryptocurrencies

Bitcoin, on the other hand, is designed (by whomever!) to be trustless. What does this mean? Two things. First, when you send value to another person using Bitcoin, there is no third-party to trust. The only thing that has to be trusted is the protocol itself, which is based on advanced cryptography which is open for anyone to study. (The previous sentence describes an almost unbelievable reality, but I’ll leave it aside for now). Second, there is no third-party backing or controlling Bitcoin’s value. No one can change how many bitcoins are in existence, nor can they alter how new bitcoins are created, nor can they declare “Bitcoin is now worth X!” The value of Bitcoin is completely based on the market, not on any controlling entity.

Furthermore, Bitcoin is open. What if the development team in charge of Bitcoin were to go astray (ahem)? If that were to happen, Bitcoin’s code could be forked and another, better, coin could be created. The value of “Bitcoin” might falter, but cryptocurrency itself – which is what Satoshi actually created – would still be a trustless, open commodity.

Satoshi Nakamoto – whomever he is – created cryptocurrencies to be trustless and open, and therefore I don’t have to trust anyone – including Satoshi himself – to use it. If Craig Wright is not Satoshi but just a conman, cryptocurrencies are still trustless and open. If Wright is Satoshi but we find out he is a raving lunatic, cryptocurrencies are still trustless and open. Either way, cryptocurrencies like Bitcoin can continue to be used securely and in a trustless manner. And isn’t that all that matters?