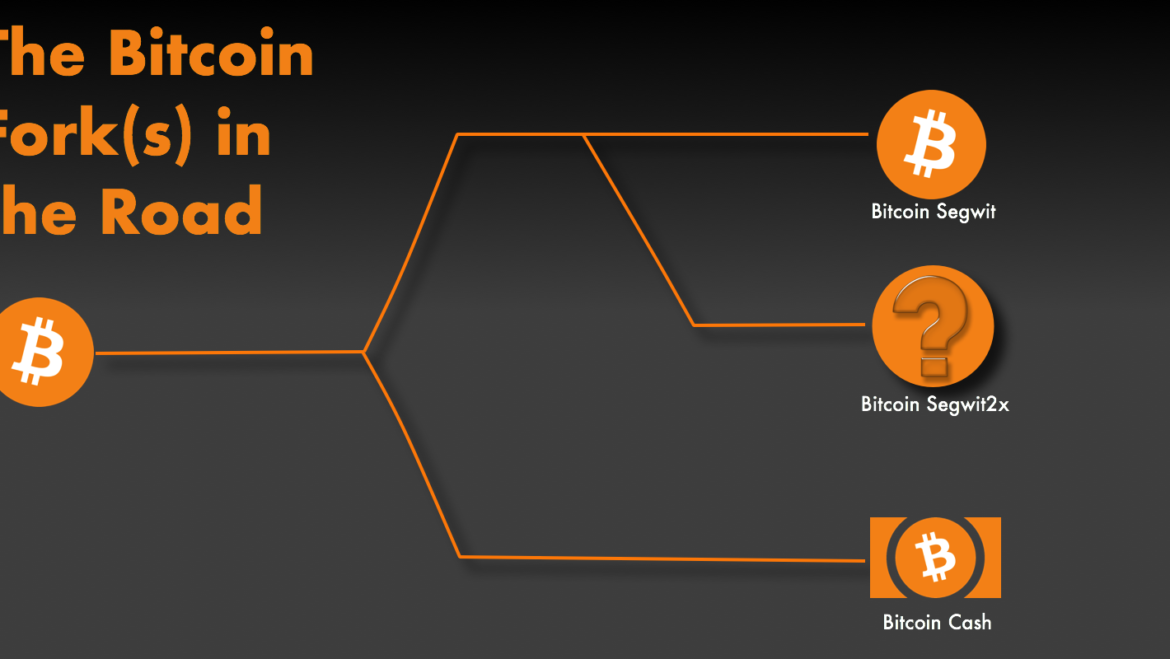

After years of acrimonious debate, it finally happened: Bitcoin experienced a hard fork. The new chain — “Bitcoin Cash” — is an attempted resolution to the long-simmering Bitcoin scalability debate. Essentially, Bitcoin Cash cloned Bitcoin, with a couple of significant changes: (1) an 8MB blocksize limit, up from 1MB; and (2) no Segwit, which was recently implemented in the main Bitcoin network. This has resulted in two distinct Bitcoin blockchains, which share the same history up until block 478558 (which was mined on August 1), but thereafter go their separate ways, with different rules to follow.

Note: in this article, for simplicity’s sake, I will refer to one Bitcoin chain as “Bitcoin Segwit” and the other as “Bitcoin Cash.” This isn’t meant to preference one chain over another, and I agree with Gavin Andresen who argues that the chain with the greatest hash power (which is currently the Bitcoin Segwit chain) should in general be referred to as “Bitcoin.” But for clarity they need to be distinguished in this article.

The fork has brought up a lot of questions. Will Bitcoin Cash succeed? If so, can the market sustain two Bitcoins, or would the success of Bitcoin Cash mean Bitcoin Segwit’s demise? And if there can be two Bitcoins, how about three, or four, or more? What is the future of Bitcoin(s)?