Bitcoin and other cryptocurrencies have from their inception faced a chicken-and-the-egg problem: merchants aren’t interested in accepting cryptocurrencies as a form of payment when only a few people own them, but only a few people will be interested in owning cryptocurrencies if no merchants accept them. Such a scenario makes it difficult for Bitcoin or any cryptocurrency to become a truly global digital payment system. To be successful, there needs to be ways to both spend cryptocurrency and earn cryptocurrency. Until the world economy is completely cryptocurrency-based, on-ramps for allowing users to spend and earn cryptocurrency are necessary.

Spending Cryptocurrency: Multiple Steps Required

When I first got into Bitcoin in 2013, there were very few places I could spend it. Later I was able to spend it using a multiple-step process: first I would use Gyft to purchase a gift card with Bitcoin, then use that card to purchase my item at a place like Amazon. What I found was that this wasn’t really that practical, and more often than not I just purchased things at Amazon with my regular dollar-based debit card.

When I first got into Bitcoin in 2013, there were very few places I could spend it. Later I was able to spend it using a multiple-step process: first I would use Gyft to purchase a gift card with Bitcoin, then use that card to purchase my item at a place like Amazon. What I found was that this wasn’t really that practical, and more often than not I just purchased things at Amazon with my regular dollar-based debit card.

A few months ago, Shift Payments introduced a Bitcoin-based debit card. Such cards existed in other countries, but the Shift card was the first to debut in the United States. Some cryptocurrency enthusiasts were decidedly against this card, arguing it was an unacceptable compromise with the existing government-issued monetary system. However, I wrote an article for Bitcoin.com which argued that such a hybrid solution was a necessary step towards a full cryptocurrency-based economy, comparing it to such hybrid solutions as AOL was to the Internet:

Currently, there are few merchants who take Bitcoin directly. Giving people a way to spend Bitcoin easily just about anywhere – even if the method is less-than-ideal – can only help Bitcoin in the long run. Once more and more people begin to use and spend Bitcoin, there will be greater incentives for entrepreneurs to innovate solutions that are truly Bitcoin-centric. At that point, the Shift Card may appear as AOL does today – an antiquated half-measure. But we may owe it a debt of gratitude for bringing many more people into the Bitcoin ecosystem.

Unfortunately, at the time the Shift card wasn’t available in my state, so I couldn’t actually use it. Recently that changed, and last week I received my Shift card in the mail.

Earning Cryptocurrency: Dash Masternodes

Of course, a Shift card has to be funded, so if I was going to use it regularly, it stands to reason that I need a regular source of cryptocurrency income. I could simply buy Bitcoin at Circle or Coinbase, but in a move to cryptocurrency, I would prefer if I also received income in cryptocurrency that could fund the card. Anything to reduce dependence on government-issued money. For a while I used Bitwage to convert part of my paycheck to Bitcoin automatically. I recommend this service highly, but of course like the Shift card Bitwage is a temporary on-ramp, not a final cryptocurrency-only solution. I recently started working full-time as a freelancer, so I don’t have a paycheck from an employer anymore I can convert. Some of those freelance jobs pay in cryptocurrency, but unfortunately most of them still pay in U.S. dollars.

But I do have a source of direct cryptocurrency income: my Dash masternodes. The Dash cryptocurrency has an innovative 2-tier network in which full nodes (called “masternodes”) are incentivized for their service by receiving part of the regular block rewards. (As a point of comparison, in Bitcoin all the block rewards go to the miners). So on a regular basis I get paid in Dash for my masternodes. And the amount is significant: in general I receive around an 11-13% return on my investment. Try achieving that with traditional investments!

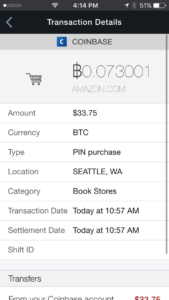

These profits I convert to Bitcoin using an exchange like Exmo or Poloniex or ShapeShift, and then transfer the Bitcoin into my Coinbase account which is linked to my Shift card. Now my Dash Masternode profits can be easily spent anywhere in the world.

Still Shifting

As you can see, spending cryptocurrency is still a multiple-step process, which isn’t ideal. A Dash debit card is in development, but it won’t initially be available in the United States (thank you, crazy KYC/AML laws!). An even more convenient process would be if there was a debit card that linked directly to the cryptocurrency of your choice (or multiple cryptocurrencies at once). Even that, of course, wouldn’t be the ideal either. A true cryptocurrency economy will only arrive when you can spend your cryptocurrencies directly to merchants around the world, without any link to existing credit/debit card systems. Fortunately, we are shifting to such an economy, but until we get there, I’ll be happy to use bridge products like the Shift card.

2 Comments

Bitwage is used by many freelancers around the world to receive regular payments or even one-offs.

Good to know, but I assume they have to deposit money directly into the Bitwage account, correct? I have a number of clients who just send me checks.

Comments are closed.