In 2016 I decided to leave my job to become self-employed. I had already lined up some clients and felt confident that I could bring in enough revenue to support my family and pay my bills. My family lives pretty frugally, so I didn’t need a lot of revenue to make ends meet. But there was one big barrier: health insurance. My previous employer offered health insurance, so leaving them meant I would have to pay for my insurance out of pocket. I did some research, and for my family of nine I found the cheapest plan to be about $1,500/month—and that was a plan with a very high deductible. That one expense would be over 35% of my total expenses, and that would only be if we never actually went to the doctor! Of course, I could just not get insurance, but then I would have to pay a penalty around $1,000/month, and pay for all my medical bills out of pocket. Needless to say, these were not attractive choices.

For a while I despaired that I wouldn’t be able to become self-employed due simply to the ridiculous cost of health insurance. But then I decided to research health sharing plans. I knew that someone in a health share was exempt from Obamacare penalties (starting in 2019, that penalty will be removed), but I’ll admit that I was initially skeptical of actually depending on such a plan. I worried that they wouldn’t really cover my medical expenses, and it seemed bordering on crazy to depend on a bunch of strangers to pay for potentially huge doctor bills. But after doing some research I decided to take a leap of faith and sign up with Samaritan Ministries.

How It Works

Essentially, here’s how it works. Each month I send a check for around $500 to another family in the Samaritan Ministries network. These checks are to pay for that family’s medical expenses. The whole process is completely automated: I get an email each month telling me to login to my account to pay my “share.” The system will tell me exactly how much to pay, what it is for (a broken arm, a pregnancy, etc), and who to send it to. Samaritan also encourages you to pray for the other member and to send them a supportive note.

My share is my total expense: about $500/month (the amount varies each month depending on the needs, but it’s always within about 5% more or less than $500). Also note that as a family with children I pay the highest monthly amount a member would pay—single people and couples without kids pay substantially less. In other words, I’m paying almost $1,000 less each month than I would with the cheapest possible health insurance. In addition, that cheap health insurance would have required a very high deductible—as much as $5,000 a year. So my total savings is up to $17,000 a year ($12,000 premium + $5,000 deductible).

Health Sharing in Practice

This all sounds good so far, but what worried me is when I had medical expenses: Will doctors accept me as a patient without insurance? Would the expenses be covered by Samaritan? Would the process to receive reimbursement be difficult? Since I’ve been a member, I’ve had to submit four separate needs, and each one was simple and straightforward. Let me give a recent example.

In December I had to take my two-year-old to the emergency room because she was having trouble breathing. They ended up transporting her by ambulance to Cincinnati Children’s Hospital, where she spent one night. Here was the total costs associated with this incident:

- Children’s Hospital & Doctors: $6,813

- Emergency Room Doctors: $812

- Emergency Room Hospital: $1,706

- Total: $9,331

Even though the incident with my daughter was relatively minor (only an overnight stay), the bills were substantial. Most of us don’t have over $9,000 sitting around in our bank accounts, even if we have a rainy day fund.

How was this handled with Samaritan Ministries? First, allow me to let you in on a little secret known as “self-pay.” When you go to a doctor or hospital, the first thing they ask you, even before asking what’s wrong, is your insurance information. However, since I don’t have insurance, I tell them that I’m “self-pay.” This magic word brings incredible discounts. And I’ve never been denied service for not having insurance. In the situation above, here are the discounts I automatically received, simply by saying I’m self-pay:

- Children’s Hospital & Doctors: $3,270 discount

- Emergency Room Doctors: $324 discount

- Emergency Room Hospital: $511 discount

So now my total bill was down to $5,226. Still a lot, but much less than $9,331. At this point, I submitted my bills to Samaritan Ministries. They have a convenient online portal where I can just upload my bills quickly and easily. They take a few days to process the need, and then they share it with the network to pay. So about a week after I submitted my bills, I logged onto the portal and was shown a list of eleven Samaritan members who would be sending me checks ranging from $200 to $500. The total amount I would receive? $5,226. In other words, the whole amount. Sometimes you have to pay the first $300 of your bill, but if you get discounts, they apply it to that amount. Since my discounts were far more than $300, I was reimbursed the whole amount.

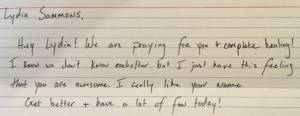

As of this writing, I’ve received seven of the eleven payments thus far, and the rest are due by April 5th. I’ve received some very nice notes as well, with members praying for my daughter—see, for example, the sweet note on the right (my daughter’s fine now, in case you were wondering). In my two years with Samaritan, I’ve only had one incident where a member didn’t send me a check. In that case, Samaritan simply asks another member to send me a check the following month (and I assume the non-paying member was removed from Samaritan’s services).

Some Caveats

Needless to say, I’m sold on Samaritan Ministries. But it’s not necessarily for everyone. There are a few caveats regarding using a health share system like Samaritan. First, pre-existing conditions are not covered. This of course excludes some people who might want to use the service, but it keeps the overall expenses to share at a reasonable level.

Second, when signing up at Samaritan (and other similar programs, I assume), you have to agree to live based on “biblical principles.” This means no extramarital sexual relations, no drinking to drunkenness, no recreational drug use, etc. This ensures that members live in a healthy manner, and also that members don’t have to pay for the immoral lifestyles of others (also note that Samaritan won’t cover abortion or contraception services).

A final caveat involves cash flow. There can be a 2-3 month time frame between the time you receive your bills and the time in which you receive your payment from other members. So you will need to either contact the hospital/doctor and work out a payment plan, or pay the bills out of your pocket and then be reimbursed later.

A Better, More Christian, Way

At this point I’m a huge supporter of health share plans like Samaritan Ministries. In fact, I find them far superior to, and far more Christian than, modern health insurance plans. For they allow Christians to share their burdens with other Christians. They are much more economical. They allow us to escape funding medical services that we find immoral. And finally, they push hospitals and doctors to charge more reasonable fees instead of their inflated insurance-based fees.

Although this sounds like a sales pitch for Samaritan Ministries, I’m not being compensated for this article (although if you sign up and mention my name, I’ll get a small referral credit on my account). But I get asked a lot about my experience with Samaritan Ministries, so I wanted to lay out my experience for others to see. I recommend them highly for anyone looking to escape the health insurance system and take care of their medical bills in a more fair, more Christian, way.

5 Comments

I’ve been reading about these plans and feel that I have a basic understanding. I don’t understand how you have been with this plan since 2016 with a family of 9, but have only had 4 medical expense claims? How is that possible?

Disclosing your specific medical procedures to the other people in your plan seems like a huge HIPAA law violation. And also, well, kinda icky.

Larry,

With a health share plan, only expenses totalling over $300 are covered. So regular checkups, for example, you pay out of pocket. In the past couple years, we’ve only had four incidents that have cost over $300.

Regarding disclosing your medical procedures, it’s totally voluntary. You of course have to let Samaritan Ministries know what the procedures are for (they are the only ones seeing the bills), but you don’t have to publicize that information to other members. But for most things people do so we know what to pray for. This isn’t a HIPAA violation, because I’m free to tell anyone I want what medical procedures I have. HIPAA only applies to the medical professionals and institutions – it has no authority over what I can tell people.

Hi, just a note. This is a great option for those who can take advantage of it. I want to point out something regarding healthcare for older people. Once a person reaches age 65, they must enrolled in Medicare A which covers hospital costs, after deductible. Unless the person is covered by an employer’s health insurance plan, they must also enroll in Medicare B (which has up to a $134 monthly premium) which covers doctors’ etc. If you need prescriptions, there’s Medicare D. This is not something a person in the United States can opt out of. Medicare is not an option. I just want to give a heads up regarding this. If you, as a self-employed, person, are paying into Social Security, you will be eligible to collect Social Security when you retire (and you HAVE TO begin receiving your Social Security Benefits by age 70), and at age 65, you not be able to avoid paying for Medicare.

Hi Eric,

Perhaps an update would be appropriate. Have you consider the Catholic Church’s health care sharing ministry? CMF CURO members participate in Health Care Sharing as members of Samaritan Ministries International (SMI), but enjoy additional Catholic benefits not included in Samaritan’s sharing program.

Please consider. . .

Eric, this is related, albeit slightly off-topic. But I’m spreading the good news (lower case!) about a whole food, plant-based diet. My guess is that if a WFPB diet would be promoted among and adopted by Samaritan Ministries members, costs for chronic diseases such as diabetes and heart problems would drop dramatically. I battled cholesterol-related problems for years before adopting the diet, and at 62 haven’t felt as good for decades. Please explore the diet for your family and, if you agree, spread the new among those who are Samaritan members. God bless you!

Comments are closed.